| NOTARIZATION SERVICES FOR INSURANCE

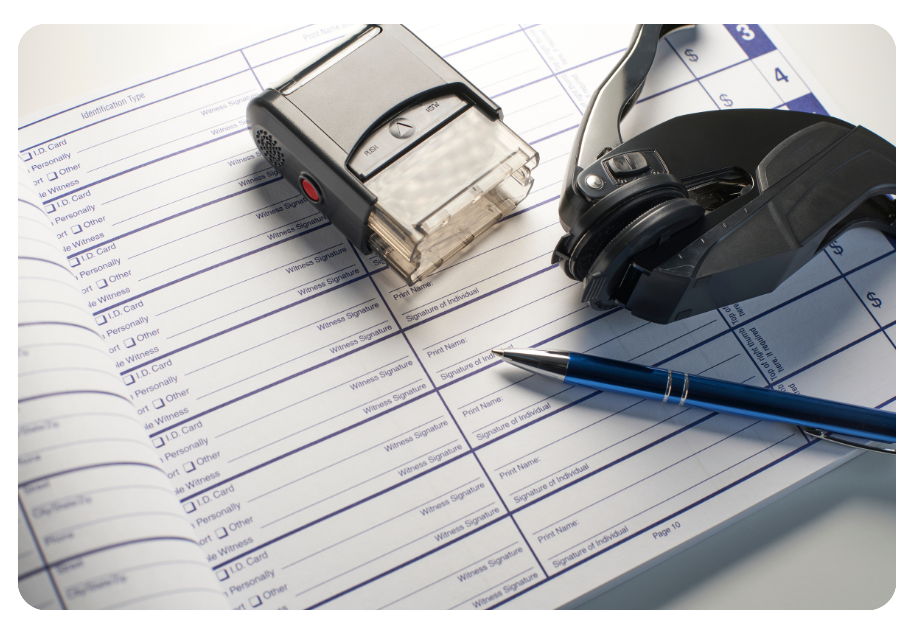

Claims, Policy, & Settlement Notarization

For insurance companies, navigating the complexities of policy agreements and claims processing, verifying document authenticity, and compliance is crucial.

Our comprehensive notary software and services offer a secure, efficient solution for remotely notarizing essential documents, including policy applications, beneficiary designations, and claims forms.

By integrating our remote online notarization (RON) capabilities into your digital workflows, you can streamline operations, enhance customer satisfaction, and maintain compliance standards.

Insurance Notarization Services Include:

Policyholder Documents

Policy Applications

Policy Amendments or Endorsements

Beneficiary Designation Forms

Ownership Transfer Forms

Claims Processing Documents

Claims Forms

Affidavits

Proof of Loss Statements

Settlement and Legal Documents

Settlement Agreements

Lien Releases

Subrogation Forms

Miscellaneous Documents

Power of Attorney Forms

Annuity Contracts

Non-Disclosure Agreements (NDAs)

Top Rated Notary Service

Our platform and notaries deliver exceptional service every day. Thousands of reviews and an average rating of 4.8/5 stars, demonstrates our commitment to satisfaction.

Transactions

Customer Satisfaction

U.S. States

Countries

| CASE STUDIES

Read how leading organizations achieve more with NotaryCam.

| ANSWERS TO YOUR QUESTIONS

Which insurance documents typically require notarization?

Insurance documents that often require notarization include:

- Policy Applications

- Claims Forms

- Affidavits

- Beneficiary Designation Forms

- Power of Attorney Forms

- Settlement Agreements

Notarization helps authenticate the identity of signers and ensures they sign documents willingly and knowingly. This process can prevent fraud and enhance the legal standing of documents in disputes or claims.

Note: Remote Online Notarization (RON) laws vary by state, and not all jurisdictions permit the online notarization of insurance documents; therefore, it’s essential to consult with legal counsel and verify local regulations to ensure compliance.

Now Hiring Notaries!

| MORE FREQUENTLY ASKED QUESTIONS

Yes, many insurance documents can be notarized online through Remote Online Notarization (RON), provided that the jurisdiction where the notary and signer are located permits it. RON can allow for secure, electronic notarization via audio-video communication, offering convenience and efficiency.

Yes, requirements vary by jurisdiction. Generally, the signer must appear before a notary public via a secure audio-video platform, present valid identification, and sign the document electronically. It's essential to comply with local laws governing online notarization, so always check with your state laws or attorney before proceeding with RON.

Yes, you can utilize Remote Online Notarization (RON) for your insurance agency, provided that your state has authorized its use. As of 2024, 47 states and the District of Columbia have enacted laws permitting some form of remote online notarization.

To integrate RON into your agency's operations, consider the following steps:

Verify State Authorization:

Confirm that your state allows RON. While many states have authorized RON, specific regulations and implementation timelines may vary.

Register Notaries for RON:

Ensure that your agency's notaries are properly registered and authorized to perform RON in your state. This may involve additional training or certification.

Select an Approved RON Technology Provider:

Choose a technology platform (like NotaryCam) that complies with your state's RON regulations to facilitate secure and compliant online notarizations.

Equip Necessary Technology:

Provide notaries with the required technology, such as computers with webcams, microphones, and secure internet connections, to conduct remote sessions effectively.

Integrating RON can help enhance efficiency by allowing clients to complete notarizations remotely, streamlining processes, and improving overall customer satisfaction. However, it's important to stay informed about your state's specific regulations and consult with legal counsel to ensure full compliance with all applicable laws.

The advantages of using RON for insurance documents can include:

Convenience: Online notarization can allows parties to complete the notarization process from any location at any time, eliminating the need for physical presence.*

Efficiency: RON can reduce processing times by streamlining document execution.

Security: RON platforms often employ robust identity verification measures, such as photo ID verification and knowledge-based authentication, to help ensure the integrity of the notarization process.*

*Remote Online Notarization (RON) laws vary by state; therefore, it's essential to consult with legal counsel to ensure compliance with applicable regulations before proceeding with online notarization for insurance documents.

*This page is provided for informational purposes only, and does not constitute legal advice, nor is it a representation, warranty, or covenant of any kind made by NotaryCam to the reader.

Your Privacy Choices

Your Privacy Choices